How to Navigate the Savings Landscape in Australia for a Secure Future

Understanding Savings Accounts

When it comes to securing your financial future, savings accounts can play an essential role. For a Brisbane-based primary school teacher, knowing the variations of savings accounts can provide a solid financial foundation for your long-term goals. During my visits to the Queensland Art Gallery, I've heard fellow community members discussing the types of savings accounts available. Generally, the forms of savings accounts range from basic savings accounts offering easy access to your funds, to more restricted accounts with higher interest rates.

Types of Savings Accounts

Embarking on the path of financial literacy, I considered a few options when choosing my savings account. Basic savings accounts provide lower interest rates but come with the advantage of convenient access, which is perfect for everyday needs. High-interest savings accounts are beneficial for savers who can meet minimum balance requirements, while youth savings accounts are tailored for younger community members eager to start saving early.

Features to Consider

While comparing features, I found that transparency and ease of use are critical for someone like me. No monthly fees, automated savings options, and online management capabilities provide freedom without the hassle. It's equally beneficial to understand the usability of tools like a term deposit calculator, which helps compare and calculate potential earnings.

Interest Rates Explained

The allure of attractive interest rates nudged me to look closer. Although they vary across savings accounts, knowing how compounding can accelerate your savings is invaluable. It's comforting to know that even small contributions in a savings account can grow significantly over time with the right interest rate.

Planning for a Home Purchase

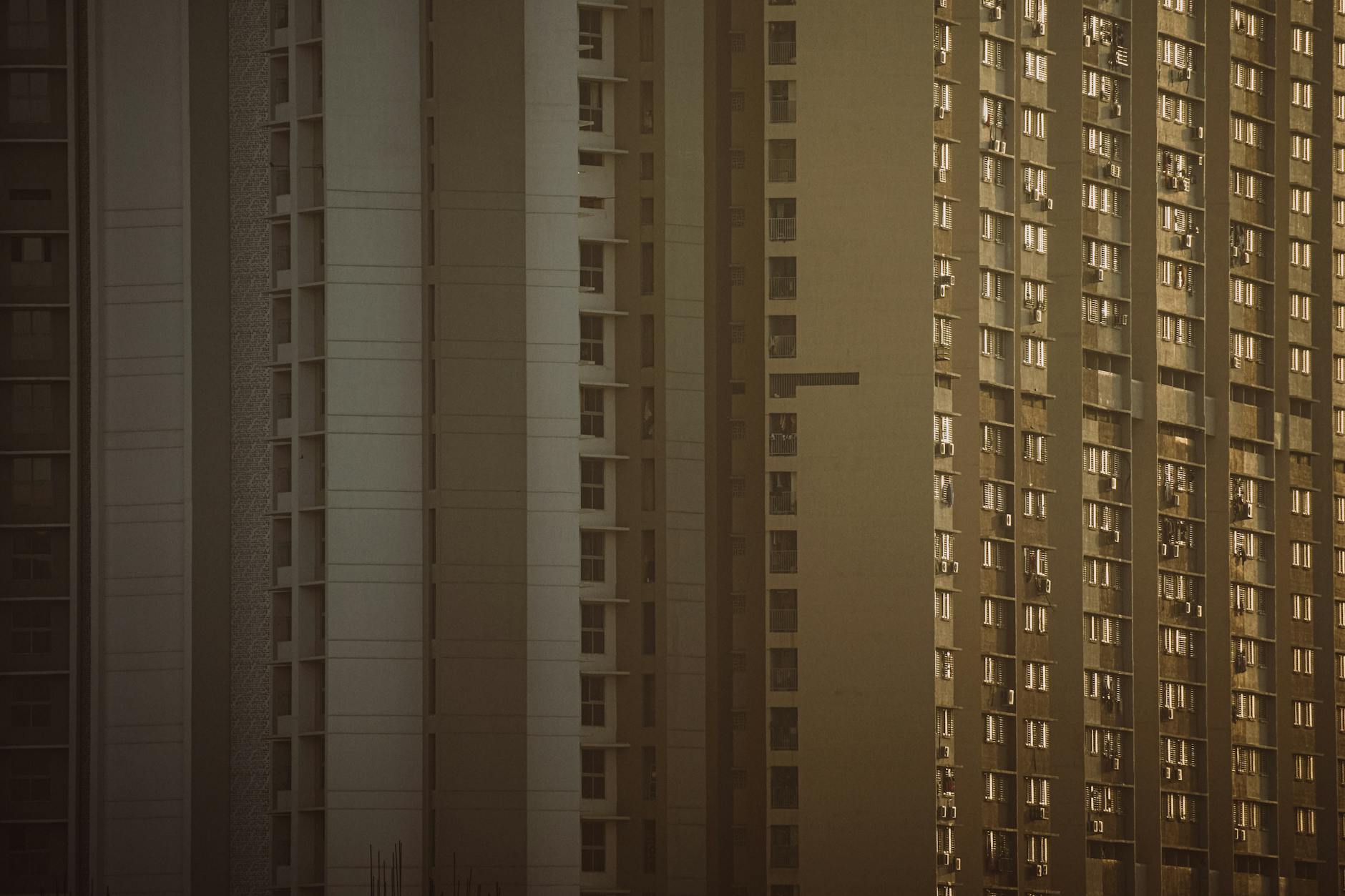

When thinking about buying a home, many of us in Brisbane find that having a plan can make a world of difference. If you're like me and regularly stroll through the beautiful South Bank Parklands, you've probably pondered the importance of setting aside money for a future home. It's crucial to establish setting savings goals early on, helping you focus your energy and resources toward achieving this significant milestone. By mapping out your savings path, you can ensure you're on track.

Joint Savings Strategies

Combining finances with your partner can be a great move when planning to buy a home. Setting up a joint savings account is a smart strategy, especially for couples thinking about shared goals. It not only simplifies the savings process but fosters a sense of teamwork, ensuring both parties are actively contributing. Setting clear rules for contributions and maintaining transparency about spending can help ensure this joint effort is successful.

Balancing Expenses and Savings

Balancing day-to-day expenses with your savings can be tricky, especially when life throws unexpected costs your way. As you navigate through this, consider exploring options like a high yield savings account australia. These accounts offer better interest rates and can help your money grow more effectively over time. Keeping tabs on these factors can allow you to enjoy the present while investing in your future.

Risk Management in Savings

When aiming for financial growth, it's essential to explore low-risk options that align with your savings goals. Opt for stable choices like term deposits and transaction accounts. These instruments typically offer lower yields but protect your principal, making them reliable for risk-averse individuals seeking to ensure financial security.

Exploring diversification techniques can further safeguard your savings. Diversifying across various account types, like fixed-term deposits and at-call savings accounts, spreads risk and can improve returns. Allocate a portion of your savings to a joint bank account with your partner to combine resources and manage long-term goals together. This collaborative strategy can bring a sense of unity and shared responsibility towards future financial stability.

In the face of inflation, safeguarding your savings is a priority. Evaluating accounts that provide competitive interest rates can aid in preserving your purchasing power. Search for accounts that adjust interest rates based on market conditions to shield your savings from inflationary pressures. Visiting the Queensland Art Gallery might also spark creative discussions about financial management, drawing inspiration from the evolving art scene to adapt your strategies with changing economic conditions.

Implementing these practices can help you manage and protect your savings against potential risks, ensuring your financial foundation remains stable and resilient.

Leveraging Financial Tools and Apps

App Recommendations

Living in a vibrant city like Brisbane, where community matters, makes managing finances essential for long-term stability. As someone who balances daily expenses with future ambitions, utilizing financial apps can simplify saving goals. Many user-friendly apps cater to various needs, from budget tracking to collaborative features for joint savings. Consider exploring options that allow you to create custom saving goals and schedule reminders. These features can be particularly helpful in visualizing progress and maintaining discipline in saving efforts. Some apps even offer integrated tools to compare savings account interest rates, helping you make informed decisions towards better returns.

Utilizing Calculators

Financial calculators can serve as invaluable tools when you're planning for significant goals, like saving for a home. They can help you estimate how much to set aside monthly based on your target amount and timeline. Look for calculators available on reputable financial websites or apps, which often come with additional functionalities, like incorporating interest rates or adjusting for inflation. Including these aspects gives a fuller picture of how your savings could grow over time.

Tracking Progress

Tracking progress is crucial in achieving financial goals. Many apps provide features like charts and reports that make seeing how far you've come easy and motivational. Setting intermittent milestones can turn long-term goals into manageable steps, reinforcing your commitment. Connecting financially with your partner can further bolster motivation, and make the journey to a stable financial future feel more collaborative.

Financial Awareness Pitfalls

Skipping the Fine Print

It’s amazing how easily we can overlook the details hidden in the fine print, but this is something we should all make an effort to avoid. Before signing up for a savings account or any financial product, take a moment to review the terms and conditions. By doing so, you might uncover unexpected clauses that could impact your savings journey. For instance, some accounts might have conditions related to maintaining specific balances, or interest rate changes that can occur without prior notice. It's essential to remain vigilant about these potential pitfalls.

Neglecting to Account for Fees

Brisbane offers enriching experiences, like a stroll through the Queensland Art Gallery or a day at the South Bank Parklands, but just as we plan our outings, we should be aware of our financial planning. Fees can erode your savings if ignored. Look out for maintenance charges, withdrawal fees, or transaction costs that can diminish the returns on your investment over time. Being proactive by reviewing these charges will ensure your savings account is truly beneficial.

Not Re-evaluating Regularly

Creating financial stability, much like nurturing a garden in the Mount Coot-tha Botanic Gardens, requires ongoing attention and care. Regularly reassess your savings strategies, keeping an eye on your progress and the effectiveness of your current plan. Life circumstances and financial goals change, and updating your strategies is crucial in adapting to these shifts. Whether it's a monthly review or a broader quarterly assessment, staying engaged with your financial health will pave the way for long-term success.